Is Investing in U.S. Real Estate from Canada Right for You? A Comprehensive Analysis

The fascination for putting their money into American property among many potential investors from Canada has greatly grown since a couple of years ago. The prospect of good profits and the US stable property market make it easy to understand why Canucks want to do so. Still, prior to entering into cross border real estate investments, you must take it for granted that this undertaking complements your goal of wealth creation, level of risk appetite, and whole investment policy.

Suppose you do decide to invest in American real estate. In that case, you should focus on multi-unit rental homes or commercial buildings, particularly those with large parking lots or additional acreage. These kinds of investments can provide you with present income and opportunities for long-term growth.

Investing in real estate is a lucrative venture, and many Canadians are eyeing opportunities beyond their borders. One such tempting prospect is the U.S. real estate market. With its vast landscapes and diverse cities, the United States offers many investment options for Canadian investors. But is investing in U.S. real estate from Canada right for you? Let's delve into a comprehensive analysis to help you make an informed decision.

Definition of U.S. Real Estate Investment

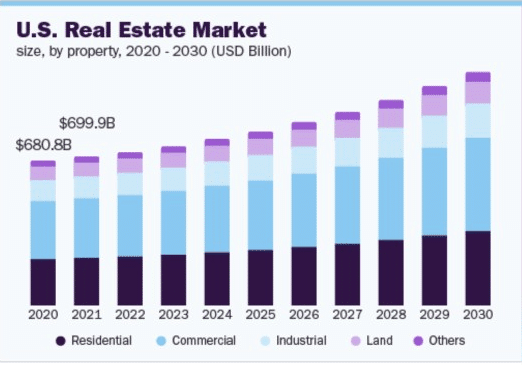

Real estate investment in the U.S. includes buying up, holding on to, and selling off lands to earn profits and boost one's wealth. Real estate investors are not just domestic but also foreign ones who want to increase their assets, protect them from inflation, and benefit from possible tax relief. Such investments may include residential, commercial, and industrial properties, and buyers may directly purchase property or indirect investment in REIT REITS or real estate partnerships. Real estate investments in the United States offer rental income, capital growth, and tax advantages. This is an attractive option for investors searching for reliable yields and accumulated wealth over time.

Bonus Advice: For most investors, stocks are a better bet than real estate, while we believe you should have exposure to foreign markets in the United States.

According to our perspective, American equities can give most investors all the international exposure they require. All Canadian investors should hold 20% to 30% of their portfolios in the American equities we suggest in the Wall Street Stock Forecaster.

You can purchase specific equities from other nations to increase foreign content. However, for most investors, directly investing in international stocks might come at an additional cost and risk. Additionally, it's only sometimes possible to find up-to-date, reliable information about foreign corporations, and national securities laws differ significantly. Your broker may find purchasing shares on international marketplaces challenging without paying a premium. Tax regulations and global money transfer limits add additional uncertainty and expense.

We still advise premium REITs with diversified holdings, including residential real estate, for investors looking to invest in real estate.

Benefits of Investing in U.S. Real Estate

Potential for High Returns

The U.S. real estate market has historically showcased impressive appreciation rates, promising substantial returns on investment over the long term.

Diversification of Investment Portfolio

Diversifying your investment portfolio across international borders can mitigate risks and enhance financial stability.

Conclusion

Investing in U.S. real estate offers lucrative opportunities but comes with risks. Evaluating the benefits, challenges, and necessary steps is vital for a successful investment journey.

Investing in U.S. real estate from Canada offers opportunities, but it demands careful planning and thorough analysis. Conduct extensive research, seek professional advice, and weigh the pros and cons diligently. Assess your financial capacity, risk tolerance, and long-term objectives. By making informed decisions, you can potentially benefit from the U.S. real estate market while mitigating risks associated with international investments.

About hay2brick

Discover Hay2Brick:

Your Trusted Canadian Real Estate Investment Partner. We specialize in multi-family properties across the USA, leveraging 15+ years of expertise for strong cash flow and appreciation. Explore secure, profitable opportunities with our seasoned team.