CANADIAN INVESTING IN US REAL ESTATE: TIPS AND STRATEGIES FOR SUCCESS FOR YOUR RETIREMENT

Are you a Canadian investor looking to explore the exciting world of US real estate? Investing in apartment buildings can be a lucrative opportunity for those seeking to diversify their investment portfolio and generate passive income. However, before diving into this venture, it is essential to conduct a comprehensive apartment investing assessment. In this blog post, we will guide you through the process of evaluating opportunities and making informed decisions for your strategic real estate ventures.

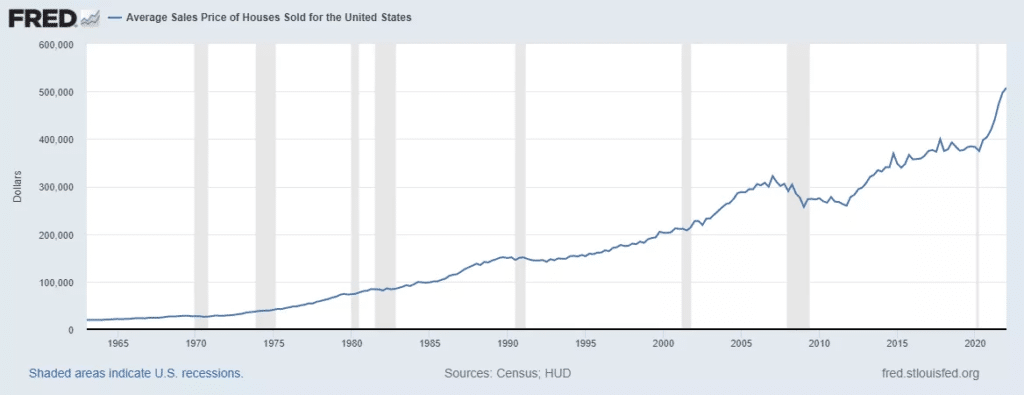

For many Canadian investors, Investing in real estate can be and has proven to a lucrative endeavor at home soil, while it has been an amazing journey in the last decade, investing at home has becoming more and more fierce in competitions and it has been getting harder and harder to find yield without excessive risk taking where the correction close to the top where we need to be mindful, many Canadian investors are turning their attention to the US market. The United States offers a wide range of robust opportunities for Canadian investors seeking to diversify their portfolios and capitalize on the potential for higher returns. All while in a close proximity to home. However, given offering many advantages to investing in US real estate as a Canadian comes with its own set of challenges and considerations. In this blog post, we will explore some essential tips and strategies for Canadian investors looking to navigate the US real estate market successfully.

Choose The Right Investment Structure:

There Are Various Investment Structures Available To Canadian Investors In US Real Estate, Such As Direct Ownership, Limited Partnerships, Real Estate Investment Trusts (REITs), And Crowdfunding Platforms. Each Structure Has Its Own Advantages And Considerations, So It's Important To Evaluate Them Based On Your Investment Goals, Risk Tolerance, And Tax Implications.

Invest With Retirement Funds

While There Are Numerous Options To Invest Into The US Markets, Many Canadian Investors Are Looking For Opportunities To Invest In The US Market Via Their Retirement Funds, Including RRSP, LIRA, TFSA Accounts.According To Research There Are Over $2 Trillion Retirement Funds Across Canadians Retirement Accounts, Naturally This Presents Canadians An Obvious Option Investing Via Their Retirement Accounts Into The US Markets.

While Many Traditional Canadian Investments Provide Canadians Exposure And Investment Opportunity On Canadian Assets, They Lack The US Component Where Many Canadians Are Seeking For In Their Portfolio Nowadays.

Worth To Mention, Canadian Investing Their Retirement Funds Into US Opportunities Required Specific Investment Structures That Needed To Be Drafted, And Designed By Experienced Security Attorney Teams Specifically For That Purpose, To Ensure RRSP, LIRA, TFSA Funds Are Investing Into What Canada Revenue Agency (CRA) Classify As Eligible Investment For These Funds.

Worth To Mention, Canadian Investing Their Retirement Funds Into US Opportunities Required Specific Investment Structures That Needed To Be Drafted, And Designed By Experienced Security Attorney Teams Specifically For That Purpose, To Ensure RRSP, LIRA, TFSA Funds Are Investing Into What Canada Revenue Agency (CRA) Classify As Eligible Investment For These Funds. With The Intention Of Providing Options To Canadians For That Purpose, Hay2Brick Created A Proper Structure, A Private Mutual Fund Trust (PMFT) To Help Canadians To Invest Their Retirement Accounts Into US Real Estate. We Have Created (PMFT) And Administered With Olympia Trust To Offer These Investment Opportunities To Those Who Want Exposure To US Investment.

Diversify Your Portfolio:

Diversification Is A Fundamental Principle Of Investing. As A Passive Investor In US Real Estate, Consider Diversifying Your Portfolio Across Different Property Types, Locations, And Investment Structures. This Approach Can Help Mitigate Risks And Increase Your Chances Of Long-Term Success.

Leverage Technology And Online Platforms:

Advancements In Technology Have Made It Easier Than Ever For Canadian Investors To Access And Analyze US Real Estate Opportunities. Online Platforms, Such As Crowdfunding Websites And Real Estate Marketplaces, Provide Access To A Wide Range Of Investment Options, Allowing You To Diversify Your Portfolio Conveniently.

Invest In US Multifamily Real Estate:

Invest In US Multifamily Real Estate With Hay2Brick. We Provide An Excellent Opportunity To Capitalize On The Thriving Rental Market In The United States. With A Track Record Of Success And A Team Of Seasoned Professionals, We Offer A Secure And Profitable Investment Avenue. By Investing In US Multifamily Real Estate, You Can Enjoy The Benefits Of Stable Cash Flow, Tax Advantages, And Potential Appreciation Over Time. Whether You're A Seasoned Investor Or New To Real Estate, Our User-Friendly Platform Makes It Easy To Explore Investment Opportunities, Access Detailed Property Information, And Track Your Returns. Join Us Today And Start Reaping The Rewards Of Investing In US Multifamily Real Estate With Hay2Brick.

Conclusion:

Investing In US Real Estate Offers Canadian Investors An Opportunity To Diversify Their Portfolios And Potentially Achieve Higher Returns. However, Success In This Venture Requires Careful Planning, Extensive Research, And An Understanding Of The Legal And Tax Implications Involved. By Following The Tips And Strategies Outlined In This Blog Post, Canadian Investors Can Navigate The US Real Estate Market Successfully And Maximize Their Investment Potential.

Remember To Consult With Professionals, Including Real Estate Attorneys, Accountants, And Experienced Agents, To Guide You Through The Process And Ensure A Smooth And Successful Investment Journey.