Building Your Portfolio: Investing in US Real Estate from Canada

Investing in real estate can be an excellent way to diversify your portfolio and generate passive income. While many Canadian investors focus on domestic properties, the United States offers a wealth of opportunities for those looking to expand their real estate investments. In this blog post, we will explore the benefits and considerations of investing in US real estate from Canada and provide valuable insights for Canadian investors looking to tap into this market.

Understanding the Advantages:

Investing in US real estate from Canada presents several advantages that make it an attractive option for savvy investors. These advantages include:

Market Size and Diversity:

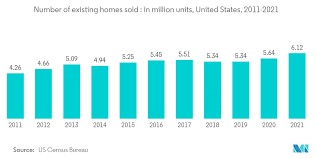

The United States boasts a vast and diverse real estate market, offering a wide range of property types, locations, and investment opportunities. From bustling metropolitan cities to serene vacation destinations, the US market can accommodate various investment strategies and risk appetites.

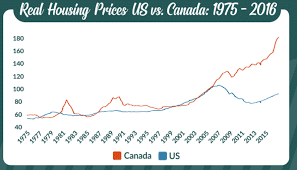

Potential for Higher Returns:

Some regions in the US have historically exhibited higher rental yields and property appreciation rates compared to the Canadian market. This potential for higher returns can significantly enhance your investment portfolio's performance.

Favorable Financing Options:

Financing options for US real estate investments are generally more accessible and flexible than those in Canada. Canadian investors can leverage various loan programs, including conventional mortgages, portfolio loans, and seller financing, to fund their US property acquisitions.

Conducting Thorough Market Research:

Before diving into US real estate investing, it's crucial to conduct thorough market research to identify areas with growth potential and align your investment goals.

Consider the following factors:

a. Location Analysis:

Assess different US markets based on factors such as population growth, employment rates, rental demand, infrastructure development, and economic stability. This information will help you identify markets that offer promising investment opportunities.

b. Property Types:

Determine the property types that align with your investment objectives, whether it's residential, commercial, vacation rentals, or multi-family units. Analyze market demand, rental rates, and potential returns for each property type in your target areas.

Conclusion

Investing in US real estate from Canada offers numerous advantages for investors seeking diversification and higher potential returns. Remember to remain diligent, seek professional advice when needed, and continuously evaluate and adjust your investment strategy to maximize your success in this exciting and lucrative market.

Start building your US real estate portfolio today with Hay2brick and unlock new opportunities for growth and financial stability.